Game PG Soft Gacor merupakan salah satu dari banyaknya provider Slot Online yang memiliki banyak sekali jenis-jenis permainan. Yang mana banyak sekali yang mudah untuk dimainkan dan juga tentunya sangat menguntungkan dengan mudahnya mendapatkan Freespin . Salah satu rival Slot Gacor dari Pragmatic Play adalah PG Soft yang tak kalah tenarnya dengan fitur permainan […]

Judi Slot Online Pgsoft

Judi Slot Online Pgsoft merupakan salah satu dari sekian banyak Provider Slot Online yang sangat digemari oleh para pecinta Slot. Pgsoft itu sendiri merupakan singkatan dari Pocket Game Soft merupakan Provider Slot Online yang memiliki basis di Eropa sana. PGSoft sendiri dikenal sebagai provider game Judi Online dimana menghadirkan permainan judi slot game online berkualitas dengan […]

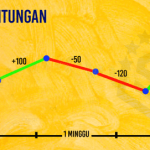

Cara Hitung Turn Over Slot Online

Cara Hitung Turn Over Slot Online yang membuat player pemain Slot Online masih bingung dengan cara hitungan yang benar. Slot Online merupakan game dasar Judi Online yang banyak dimainkan oleh pecinta Slot Online di Indonesia. Hal itu di ketahui dari perkembangan jaman permainan slot online menjadi sangat ramai di bicarakan di Kalangan Masyarakat Indonesia. Pecinta Judi […]

Pola Slot Bonanza Gacor 2022

Pola Slot Bonanza Gacor 2022 akan kami berikan rumusan untuk anda semua pecinta sloter mania agar cepat maxwin. Slot Bonanza merupakan salah satu game terlaris yang ada pada Situs Slot Gacor yang ada di Indonesia. Hal ini diketahui karena banyaknya Situs Slot Gacor yang mempromosikan game Sweet Bonanza pada provider masing masing. Bukan hanya Sweet Bonanza […]

Peraturan Slot Gacor Untuk Pemula

Peraturan Slot Gacor Untuk Pemula yang perlu diketahui untuk anda yang baru saja ingin bermain slot online ataupun dengan yang sudah mengenal Slot Gacor secara lama. Dalam peraturan bermain Slot Online tentu kita memiliki pola gacor atau trick masing masing yang tidak kita ketahui sampai saat ini. Dalam panduan Slot Online untuk pemula ini, kami […]

Baca Pola RTP Tertinggi

Baca Pola RTP Tertinggi akan mimin ajarkan kali ini untuk anda pemula Slot Online atau yang sudah lumayan lama mengenal perjudian Slot. RTP merupakan suatu presentasi game Slot Online yang tentukan Gacor tidak game tersebut jika anda mainkan. Sebuah game slot online bisa jadi Slot Gacor sebab karena miliki RTP yang tinggi dengan win rate […]

Slot Merusak Pikiran Manusia

Slot Merusak Pikiran Manusia merupakan induk dari masalah yang akan kita bahas Slot Online bisa rusak pikiran manusia. Kita sebagai manusia tidak luput dari namanya games atau pun sejenis yang berhubungan dengan itu. Apalagi kalau main game dapat uang, Tentu saja hal itu sontak membuat kita semakin asyik dalam bermain game tersebut secara visual atau […]

Slot Gacor PG SOFT

Slot Gacor PG SOFT adalah salah satu game favorit untuk seluruh player Slot yang tentu peminat sangat banyak selain Pragmatic Play. Pecinta Slot PG SOFT juga sudah tak asing lagi dengan banyak game yang ada pada provider tersebut. Tentu yang tidak kalah menarik dari Provider PGSOFT adalah permainan yang asyik dengan fitur fitur wild yang […]

Game Pragmatic Gacor

Game Pragmatic Gacor adalah salah satu game terfavorit dan paling banyak pengikut dari berbagai pelosok dunia manapun. Pragmatic merupakan provider terbaik untuk game Slot Online sepanjang masa yang perlu diketahui oleh pemain Slot Terbaik. Slot Gacor Pragmatic Play merupakan salah satu game dengan performa terbaik menghadirkan berbagai kejutan fitur menarik dan tentu tampilan yang selalu mendukung. […]

Tutor Bermain Zeus Gacor

Tutor Bermain Zeus Gacor akan kami berikan bocoran dengan beberapa tahap untuk kalahkan Slot Zeus. Karena untuk mengalahkan Slot Gate Of Olympus tidak hanya dibutuhkan teknik dan skill dalam bermain. Tentu anda juga harus siap membaca tutor dari kami untuk dapat taklukkan Slot Zeus. Sebelumnya games Slot gate of olympus merupakan slot yang paling sering […]